Weltenergierat–Deutschland is the national member representing the Federal Republic of Germany at the World Energy Council. Its members include companies in the energy industry, associations, academic institutions and individuals. As a non-governmental, joint profit association, Weltenergierat-Deutschland is independent in its opinion. Its objective is to implement and disseminate key World Energy Council insights and knowledge in Germany, in particular, to bring the global and longer-term issues and needs of the energy and environmental policy to the attention of the national debate. To this purpose, it organises its own events and carries out its own studies.

Carsten Rolle, Secretary General of the German Member Committee of the World Energy Council since 2005, holds a PhD in economics from Münster University. After his studies, he managed the department for telecommunications and postal services at the Federation of German Industries (BDI) in Berlin. Since 2008 he has been the Managing Director of the Energy Policy department.

Maira Kusch is Head of Office at World Energy Council – Germany. From September 2020 to December 2021, she held the position of Senior Manager at WEC Germany. Before joining the World Energy Council network, Maira Kusch worked as Senior Consultant for energy, environment and mobility at the EPA European Berlin Brüssel Political Affairs GmbH, a strategic consultancy based in Berlin, and as Policy Advisor for Matthias Groote, MEP, in the Committee on the Environment of the European Parliament in Brussels and Strasbourg. She holds a Master’s degree in International Studies / Peace and Conflict Research and a Bachelor’s degree in European Studies. Maira is co-author of the book “Flüssiggas und BioLPG in der Energiewende” (“The Role of Liquefied Petroleum Gas and BioLPG in the Energy Transition”), published at VDE VERLAG, Berlin in 2020.

Energy in Germany

ENERGY ISSUES IN MOTION

Germany’s domestic energy reserves are limited, making the country still heavily reliant on energy imports. In 2024, imports accounted for 98% of mineral oil, 95% of natural gas, and 100% of hard coal that were needed to meet the country’s primary energy demand. Renewable energies (RE) and lignite are the only significant domestic energy sources available to Germany. Norway was Germany's most important energy raw material supplier in 2024.

2024 also marked Germany’s first full year without nuclear power generation since 1962, following the shutdown of the last three nuclear power plants in April 2023. In their final year (2022), the remaining plants contributed 6.1% to the country’s electricity generation. This share was replaced by renewable energy sources, and imports, in 2024. Electricity generation in Germany reached a record share of renewable energy of 57.8% in 2024. Due to significant reductions in lignite (-8.4%) and hard coal (-27.6%) use, the German electricity mix was the least CO2 intensive it has ever been. In 2024, the share of renewables in primary energy consumption amounted to 20% as well as to 55% in gross domestic electricity consumption.

Compared to the previous year, primary energy consumption decreased by 0.6%. One factor contributing to this development was a 0.2% reduction in economic growth compared to 2023 with energy intensive branches suffering even worse. High uncertainties regarding both domestic and international economic prospects dampened demand, production, investment, and private consumption.

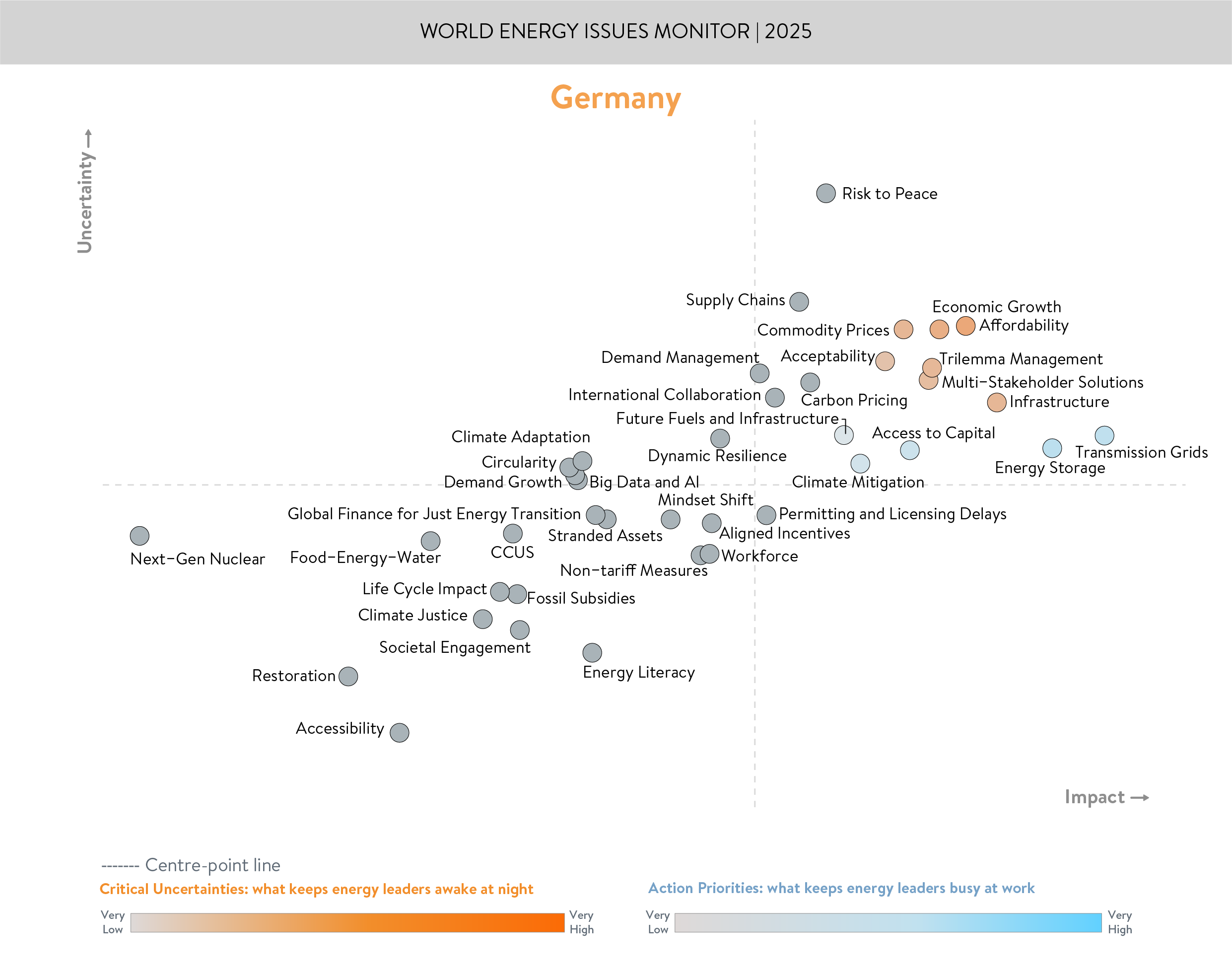

Alongside economic growth, and security of supply, affordability especially for industrial customers was the most frequently cited uncertainty. While wholesale prices for fossil fuels stabilised in 2024, they remained at relatively high levels in an international comparison. European natural gas prices, linked to the more expensive liquefied natural gas (LNG) prices, continued to be more than twice as high as before 2022 and up to five times higher than in the U.S. This brings with it another critical uncertainty: commodity prices. Energy market uncertainties, especially in the raw materials sector, are heavily influenced by geopolitical tensions, particularly in the Middle East. These factors also contribute to the critical uncertainty of the trilemma management, which seeks to balance energy security, affordability, and sustainability.

Two other societal uncertainties are multi-stakeholder management and acceptability, which are crucial to the success of the energy transition. For instance, collaborative approaches are essential to garner support for major infrastructure projects, such as the SuedLink which will transport wind energy from Northern to Southern Germany. Representatives of the political and business sector as well as local communities work together to address concerns and secure regional support for this important power line.

At the end of 2024, Germany’s federal coalition government collapsed, leading (among other things) to the postponement of many infrastructure projects. However, a special fund of €500 billion was approved by parliament in the beginning of 2025, which foresees many necessary infrastructure projects for the coming years.

FROM BLIND SPOTS TO BRIGHT SPOTS

A key element for decarbonising the German industry is the use of hydrogen-based technologies, particularly for processes that are difficult or impossible to electrify, as well as for replacing fossil raw materials in material use. Hydrogen and its derivatives are also expected to play a role in the transport sector, particularly in heavy-duty transport, aviation, and shipping. The German government’s National Hydrogen Strategy projects a domestic demand of 95 to 130 TWh by 2030.

In October 2024, the Bundesnetzagentur, Germany's main authority for infrastructure, promoting competition in the markets for energy, telecommunications, post and railways, approved the hydrogen core network, by this clearing the way for the transport and use of future fuels and their infrastructure. A network of 9,040 kilometers of pipelines – around 60% of which will involve the repurposing of existing natural gas pipelines – will be gradually put into operation from 2025 to 2032. The expected investment costs amount to €18.9 billion.

Similarly, the Network Development Plan for a climate-neutral electricity transmission grid network was confirmed. For the first time, nearly 90 major electricity distribution network operators presented expansion plans for a climate-neutral distribution network. Significant progress was also made in the approval of large transmission lines: the number of transmission kilometers on land that are either approved or under construction has quadrupled within three years; offshore, an additional 1,000 kilometers are under construction. German government managed to shorten the time framework for planning and licensing of new electricity infrastructure significantly. The Bundesnetzagentur has taken a first step towards a more equitable regional distribution of distribution network expansion costs.

Parallel to the expansion of renewable energy sources and networks, the need for energy storage is also increasing. Installed battery capacity surged to 12.1 gigawatt (GW) (up from 8.6 GW in 2023), and storage capacity grew from 12.7 gigawatt hour (GWh) to 17.7 GWh in 2024. The capacity of Germany’s pumped storage plants now stands at around 10 GW.

Germany has reduced its CO2 emissions by 48% since 1990, achieving an additional 3.4% reduction in 2024 compared to the previous year. The country continues to pursue the goal of reducing 65% of its emissions by 2030 and achieving climate neutrality by 2045. These targets were further reinforced with the amendment of the Federal Climate Action Act, which came into effect in the summer of 2024.

The new climate protection law focuses on future emissions developments to ensure that Germany meets its climate targets, thus strengthening the overall responsibility of the federal government in reducing greenhouse gas emissions. It also increases transparency across all sectors and strengthens the Council of Experts on Climate Change, which will now validate projections and offer its own proposals for promoting climate mitigation.

Achieving the stated reduction targets requires significant access to capital. Of the extraordinary infrastructure fund of €500 billion, approved by Bundestag and Bundesrat in March 2025, €100 billion will be directly allocated to climate protection measures and the transformation of the economy.

To meet the annual investment needs and stimulate private investments, public expenditures are necessary in the areas of public infrastructure (such as buildings and transport), incentives for private investments to close economic gaps, and subsidies and compensation payments to avoid excessive cost burdens on citizens and businesses.

Acknowledgments:

Germany Member Committee

Burkhard von Kienitz

Maira Kusch

Anna Molchanova

Dr Carsten Rolle

Prof. Dr Hans-Wilhelm Schiffer

Downloads

Germany World Energy Issues Monitor 2025 Country Commentary

Download PDF

World Energy Issues Monitor 2025

Download PDF

Germany World Energy Trilemma Country Profile 2024

Download PDF