The Energy Council of South Africa is a CEO-led initiative that brings together key public and private sector companies, business/industry associations and finance institutions that have a significant presence and actively participate in the energy sector.

ENERGY IN SOUTH AFRICA

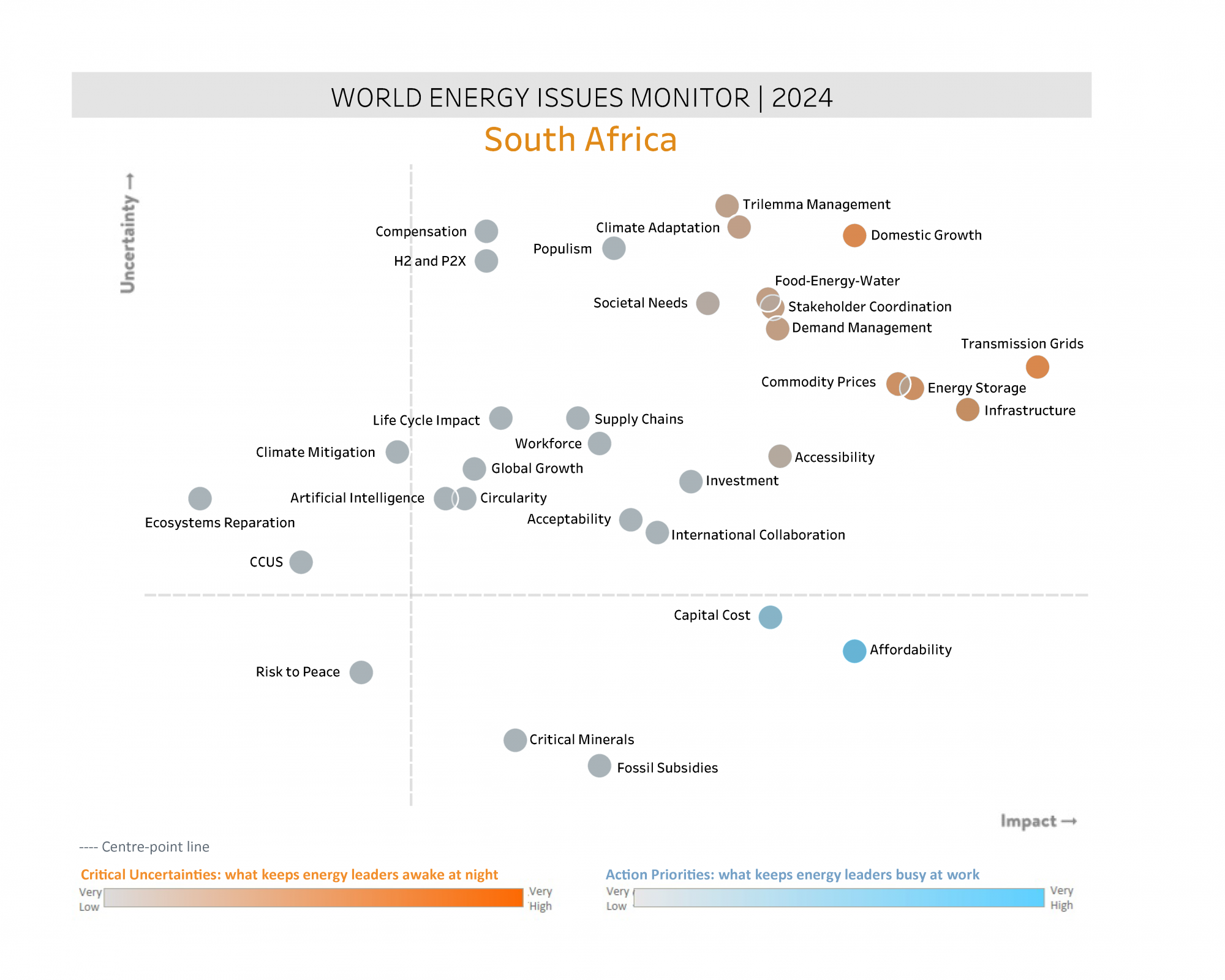

Transmission Grid an obstacle to new supply and decentralising power generation

South Africa’s grid is increasingly constrained and can only support a limited amount of new generation capacity without major capital expansion. This is creating a regional mismatch between the availability of grid capacity and project demand particularly for renewable energy. For instance, the best renewable resources are found in the Western regions, which have no spare grid capacity for new generation projects.

Eskom, in their Transmission Development Plan (TDP), have identified the need to build a new 765 kV corridor which will expand the transmission network's capacity. The TDP also outlines the necessity to install over 14,000 km of new high-voltage powerlines and 105,865 MVA of transformer capacity in the next decade to enhance grid connection capacity. However, the project delivery is heavily backloaded, with substantial acceleration only being realised from the 2027 financial year due to funding challenges.

The uncertainties surrounding grid expansion also include the need for grid modernisation to support renewable energy integration and market reform for increased grid accessibility. Uncertainties on financing models with lack of cost reflective tariffs are also challenges that constrain development of grid. Transmission Grids are viewed to have greatest impact with some critical uncertainties in the short to medium term.

South Africa's Domestic Growth remains lacklustre

South Africa has experienced weak domestic growth during the past decade. Growth of Domestic Product has averaged only 0.8% annually since 2012, entrenching high levels of unemployment and poverty. Over the next three years, South Africa’s economy is forecast to grow at an average of 1.6%, a moderate improvement but well below the national development plan target of above 5%, which is needed to address unemployment.

For the past few years, South Africa has been experiencing heavy rotational power cuts, locally termed Loadshedding. The South African Reserve Bank (SARB)’s latest estimate is that load-shedding reduced economic growth in 2023 by around 1.8%. It cost the South African economy an estimate of R204-R899 million per day (during stage 3-6 loadshedding) in 2023, with the Mining, Agriculture, Forestry and Fishing, and Manufacturing sectors being most affected. Load shedding also damaged investor confidence in the economy's stability and reliability, which deterred domestic and foreign investment. This, in turn, affects GDP growth as investments are necessary for economic expansion.

To turn the tide and raise economic growth sustainably, government has prioritised energy and logistics reforms, along with measures to arrest the decline in state capacity. Successful efforts to improve the fiscal position, complete structural reforms and bolster the capacity of the state will, in combination, reduce borrowing costs, raise confidence, increase investment and employment, and accelerate economic growth. There is high uncertainty of domestic growth which has greater impact on the energy transition.

Sticky commodity prices for South Africa

South Africa's economic landscape is greatly influenced by commodity price fluctuations both locally and globally. Oil plays a vital role in the economy but faces volatility due to geopolitical tensions and changing energy consumption patterns. Coal faces significant price uncertainties as it is influenced by multiple factors. Increasing environmental regulations and carbon pricing measures globally can reduce coal demand, impacting prices as industries shift towards cleaner energy alternatives.

The Just Energy Transition (JET) and South Africa’s commitment to the UNFCCC Net Zero are expected to have a substantial effect on coal prices. As countries commit to reducing carbon emissions and transitioning towards cleaner energy sources, there will be a decreased demand for coal. This decline will apply decreasing pressure on coal prices. Stringent environmental regulations, such as the Climate Change Bill, and carbon pricing mechanisms can further disincentivise coal use, leading to reduced consumption, therefore lower prices. Although South Africa has committed to decarbonising, the country is heavily dependent on coal and to support energy security has delayed closure of coal stations. While this will support further coal demand, it increases the risk of higher emissions and CBAM.

The reliance on fossil fuels will decrease but a new reliance on metals and minerals will emerge. Platinum Group Metals (PGMs) are used to produce hydrogen. Hydrogen is clean energy and can play a significant role in decarbonising various sectors. Manganese is essential for electric vehicles (EVs) and energy storage systems (ESS). South Africa is a major producer of PGMs and manganese and stands to benefit from increased demand for these metals as global markets shift towards clean energy technologies. Expanding mining and processing operations can create jobs and stimulate economic growth.

Overcoming economic bottlenecks through infrastructure investments

In the past five years, South Africa has faced power supply issues due to inadequate infrastructure maintenance, leading to frequent power cuts. Eskom is seeking financial assistance to address these challenges. Investments from the public sector, such as the relief fund provided to Eskom, are essential for infrastructure development and improving power supply. Business for South Africa (B4SA) is a collaborative effort between the government and business CEOs. The objective of this initiative is to mobilise business resources and capacity to work alongside and in support of government to address restrictions impacting economic growth and social development in South Africa.

South Africa's action priorities focus on improving infrastructure resilience, expanding renewable energy capacity and modernising the transmission network. The Energy Action Plan’s objective is to address South Africa's power challenges through diversifying energy sources, improving infrastructure, and promoting energy efficiency. The plan emphasises reducing reliance on coal while ensuring a reliable and stable power supply. It seeks to attract investment in energy infrastructure, support job creation in renewable sectors, and mitigate climate impacts. The passing of the Electricity Regulation Amendment Bill indicates a legislative commitment to improving infrastructure maintenance and ensuring reliable electricity supply. This includes efforts to prevent load shedding through increased generation capacity and grid stability.

Initiatives such as the Renewable Energy Independent Power Producer Procurement Programme (REIPPPP) are pivotal as they aim to expand and modernise the electricity grid to accommodate renewable energy sources. Bid Window 7 under REIPPPP, targeting 5000 MW of renewable energy capacity, highlights ongoing efforts to scale up renewable energy generation.

Addressing energy poverty by making energy affordable

Energy affordability is a critical issue in South Africa, as a significant number of the population struggles to pay for basic energy needs. High energy costs disproportionately impact low-income households, forcing them to allocate a larger portion of their income towards energy expenses. Energy affordability restricts economic development, as businesses face higher operating costs and may be less competitive in the global market.

The South African government is aware that energy affordability is an action priority and has implemented energy subsidies, invested in distributed generation, smart grids, energy storage technologies and in energy infrastructure in order to improve energy efficiency and ensure electricity affordability. For these to work, the country needs a functioning municipal system.

Municipal reform is essential for efficient governance. Municipalities own half of South Africa's total distribution infrastructure and account for about 40% of Eskom's sales. In particular, municipalities distribute electricity primarily to smaller, residential consumers. Without reliable municipal distribution networks, South Africa will struggle to achieve affordable and universal electricity access. Many municipalities are in debt cycle where they are unable to cover their expenses and invest in maintaining and upgrading their infrastructure. This high debt prevents municipalities from entering into new service agreements required for energy transition.

The JET seeks to achieve sustainable development goals while promoting social justice and inclusivity, ensuring that no one is left behind in the move towards a low-carbon economy. It is estimated that over one hundred and eleven thousand (111 000) jobs are at risk due to the transition from using coal to a more renewable energy economy. This transition could further the inequality gap in South Africa. To ensure that no one is left behind, the government needs to invest in skilling individuals for jobs in new economy and manage physical and cultural dislocation to increase economic participation.

Acknowledgments

South Africa Member Committee

Downloads

South Africa World Energy Trilemma Country Profile 2024

Download PDF

World Energy Trilemma Report 2024

Download PDF

South Africa World Energy Issues Monitor 2024

Download PDF

_-80_result_688_387_s_c1_c_c.jpg)