The Spanish Committee of the World Energy Council (CECME, acronym in Spanish) represents the WEC in Spain and coordinates the participation of the Spanish energy industry in WEC’s activities, serving as liaison between WEC and the Spanish members. CECME is a part of the Spanish Energy Club (www.enerclub.es), which is a nonprofit organization with more than 300 Associates whose main goal is to contribute to a better understanding of the different energy issues. The main activities of the Spanish Committee include organizing energy-related events in Spain, representing CECME and the World Energy Council in national events, disseminating documentation and collaborating with World Energy Council and its working groups.

Pedro Vasconcelos, Executive Board Member at EDP and Member of EDP Renewables Management Team with Iberia and APAC regions, Global Energy Management platform, Regulation, Markets and Stakeholders division portfolio.

Pedro Vasconcelos is an Executive Board Member at EDP and a Member of EDP Renewables Management Team, overseeing Iberia and APAC regions, in addition to the Global Energy Management platform and Regulation, Markets and Stakeholders division. Pedro is CEO of EDP España and also a Member of the Board of Ocean Winds, EDPR’s dedicated offshore joint venture with Engie.

Pedro’s previous roles at EDP include Chief Operating Officer for APAC, Head of M&A and Corporate Development, Head of Solar Strategy, and executive roles at EDP Inovação, EDP International and Hydro Global as Chief Business Development Officer. Pedro holds an MBA with Distinction from INSEAD, Singapore/France and an MSc in Aerospace Engineering from Instituto Superior Técnico, in Portugal.

Joined EDP in 2007, working as an M&A Project Manager until 2009. He was then seconded to NGEN Partners, a California-based cleantech US venture capital firm, as an Associate, before returning to Lisbon two years later to become EDP's CEO and Chief of Staff until 2013.

Ana Padilla works as a Project Coordinator at the Spanish Energy Club and is based in Madrid, Spain. Ana joined the Spanish Energy Club in 2008. Prior to that, Ana worked at the International Energy Agency in Paris.

Energy in Spain

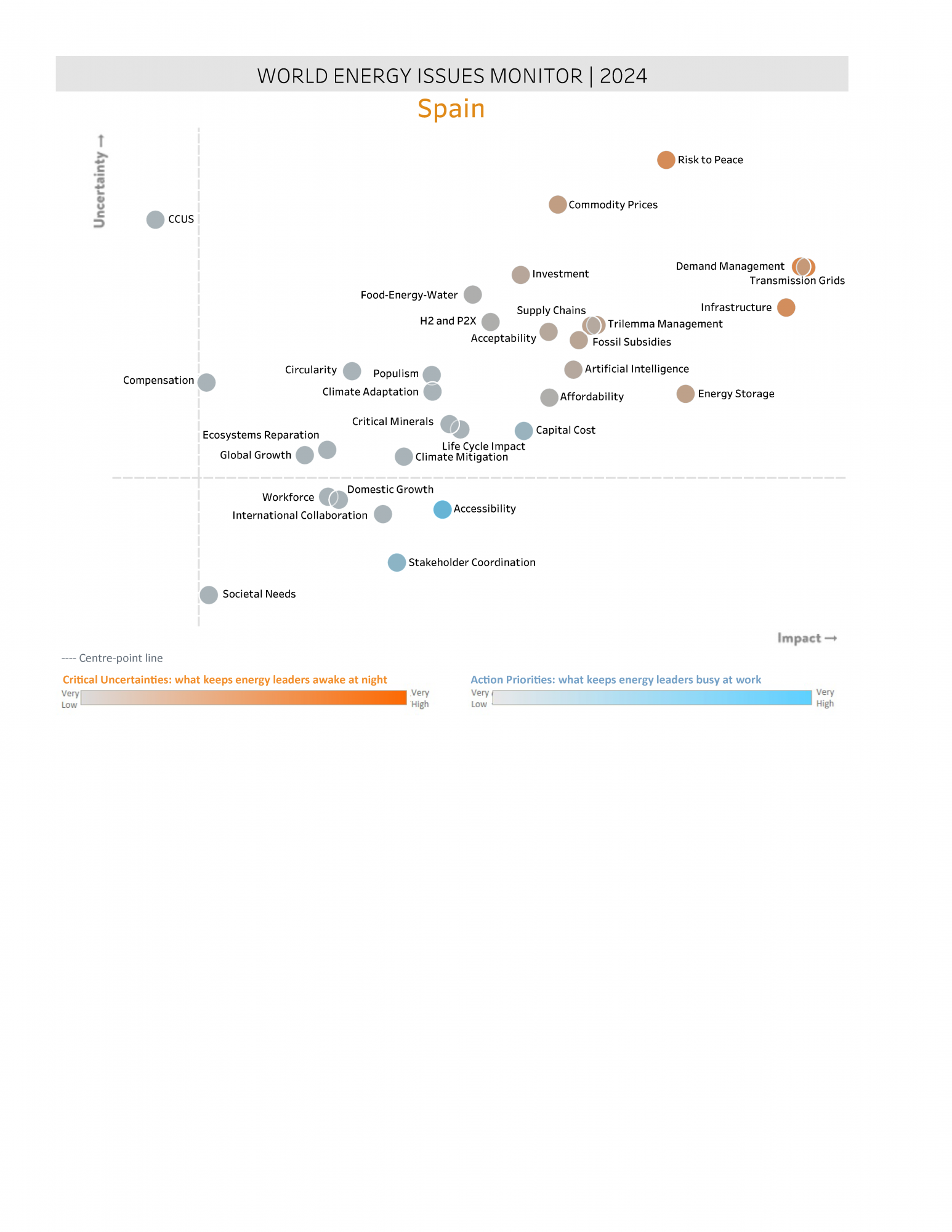

Uncertainty around most issues remains and has even increased in 2023 compared to the previous year. More than two years after the start of the war in Ukraine, the geopolitical environment, far from relaxing, has become more complicated, now due to the escalation of the Palestinian-Israeli conflict and the growing tension in the Middle East. Not surprisingly, Spain’s highest critical uncertainty is the risk to peace. In addition, Spain’s intense political year, with general elections and several regional and local electoral processes, has contributed to the high level of uncertainty.

Following closely behind as issues of concern are trilemma management, supply chains, and, most notably, commodity prices, whose uncertainty has decreased slightly compared to last year, moving from first to second position. After the historically high levels reached in 2022, with effects still visible in the economy and among citizens, and with a wide range of measures implemented, energy prices have dropped considerably in Spain. Gas prices have returned to 2021 levels, prior to the conflict. Wholesale electricity prices have decreased by more than 90% compared to 2022. There have even been days, such as April 1st, with negative values during some hours.

The debate about the need to adapt wholesale energy markets to the new realities has continued during 2023, emphasizing the importance of working in multiple areas. These include those related to energy storage and demand response mechanisms (both located in the area of high impact, but the second with a higher level of uncertainty), or the use of formulas that make retail prices more stable, such as Power Purchase Agreements (PPAs), Contract for Differences (CfDs), and long-term contracts. Progress has been made on these issues with the approved reform of the EU electricity market, in which the Spanish Presidency of the EU Council has played a very important role.

Also, as can be seen in the map, despite the undeniable importance of infrastructures and, in particular, transmission grids to the success of the energy transition, there is still a high level of uncertainty about them. This highlights the need to plan actions in this area and adjust the economic retribution of the grids to the necessities of the system. The review of the National Climate and Energy Plan (NECP) 2021-2030, which must be finalised and submitted to the European Commission in July 2024, and the legislative development necessary for its fulfilment; the implementation of all the projects included in the Recovery Plan; and the progress being made in updating the Electricity Network Planning to 2026 will help in this regard.

Renewable energies continue to be the main driver of the transition in Spain. During 2023, their implementation has accelerated, with about 8 GW of new installed capacity (reaching about 79 GW in total, an 11% increase vs. 2022) and a new historical record (producing more than 50% of electricity generation on average for the year). Some of the top action priorities are now related to the renewable targets for 2030 (48% in final consumption and 81% in power generation, based on the new NECP proposal) and the need to overcome some of the challenges ahead. These include dealing with the increase in capital cost, the importance of greater coordination among multiple stakeholders to speed up administrative, network processes, permitting, and new technologies promotion, or social acceptability to avoid new project delays. The aforementioned energy storage has also moved to the block of priority actions with an objective in the proposed NECP to have 22 GW by 2030 (rising from the goal established in the Spanish Energy Storage Strategy of 20 GW).

In this area of new technologies for the transition, hydrogen continues to have high uncertainty, although lower than the previous year, keeping the Spanish industry busy at work, as it responds with many projects and investments to reach the ambitious national targets and make the country a carbon-neutral economy by 2050 (Spain represents around 20% of the renewable hydrogen projects announced worldwide in 2022, only behind the United States). The proposed NECP includes an objective of 11 GW of electrolysers for renewable hydrogen production by 2030 (representing an increase over the Green Hydrogen Roadmap published in 2020, which set a target of 4 GW). The EC has recently published the results of the first Pilot Auction for Renewable Hydrogen, with the selected bids concentrated in four countries, leaving the Iberian Peninsula clearly very reinforced (595 MW would be installed in Spain, almost 40% of the total). Although not assessed in the map, gases such as biomethane and biofuels, offshore wind, and digital technologies such as AI are currently receiving greater attention.

Affordability, domestic economic growth, and workforce have also gained prominence as action priorities. Spain's commitment to the energy transition agenda is clear. The country has great ambitions and a strong position for this process, seeing it as a necessity to combat climate change and reduce its external energy dependence while also taking advantage of opportunities in booming sectors, providing economic growth, sustainable employment, and industrial competitiveness. The allocation of resources, including those from the Next Generation EU, the alignment of supply and demand, and the integration of society, the different stakeholders, and sectors in the debates are going to be key. In this area, the Spanish Just Transition Strategy, which aims to address some of these issues, is of great relevance.

Acknowledgements

Spain Member Committee

Downloads

Spain World Energy Trilemma Country Profile 2024

Download PDF

Spain Energy Issues Monitor 2024

Download PDF

World Energy Issues Monitor 2024

Download PDF